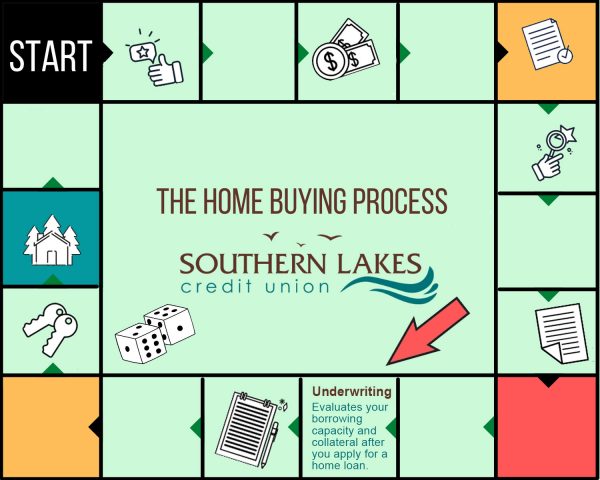

08/2/21: Monopoly Mortgage Monday – Underwriting

Welcome back Southern Lakes Credit Union members to Mortgage Monopoly!

Time to roll the dice again! You give them a shake, toss them across the board and this time you land on the Underwriting square.

The mortgage underwriting process determines that your qualifications match the criteria for the loan program you have chosen and the strength of the home you have chosen to purchase as part of the deal. In technical terms, mortgage underwriting evaluates your capacity to repay the loan and the collateral that will secure the loan.

What Is the Mortgage Underwriting Process?

In the mortgage underwriting process, an underwriter evaluates your borrowing capacity and collateral after you apply for a home loan. These steps include verifying your identity, checking the stability and amount of your income, verifying your employment, reviewing your tax returns, examining your financial statements, and perusing your credit reports.

If everything checks out during underwriting, your mortgage application will be approved and you continue to proceed towards closing.

Guided by lender, investor, and federal requirements, a mortgage underwriter will analyze your finances to make sure you aren’t a risky borrower. They want to see how your monthly income compares to your monthly debt payments, how steady your employment has been, and whether you’re likely to continue earning a similar income for the foreseeable future. They’ll also analyze your application and supporting documents to ensure consistency.

Additionally, mortgage underwriting makes sure lenders follow laws about qualifications for certain loan programs. For example, an underwriter will need to make sure a Veteran’s Administration home loan applicant has met the VA mortgage program’s military service requirements. Or, they might need to make sure a conventional mortgage applicant with a low down payment meets a minimum credit score so the loan can be sold to Fannie Mae, one of the government-sponsored entities that helps support the U.S. home mortgage system.

Underwriters must follow objective guidelines in evaluating a prospective borrower’s application. Discrimination on protected characteristics in mortgage lending is illegal.

What the Mortgage Underwriter Evaluates

The mortgage underwriter evaluates every aspect of your finances that lenders want to know about to decide whether you’re an acceptable credit risk. Basically, the underwriter needs to prove to the lender that you’re likely to repay the loan. That means they’ll be looking at these factors:

- Income: Do you have a history of steady income that’s likely to continue? Is it enough to pay for the mortgage you’re applying for, along with property taxes, insurance and homeowners association fees?

- Assets: Do you have the cash needed to close? Will you have enough cash reserves left after closing to weather any disruptions to your income or expenses?

- Credit: Does your credit score meet the program criteria? Are there derogatory items on your credit report? How serious and how recent are they?

- Debts and other liabilities: What are your total monthly debt payments? Does your income level support your current debt payments with the new mortgage payment? Are you obligated to pay child support or alimony?

- Collateral: Does the home appraise for at least as much as the contract price?

Potential Underwriting Outcomes

The result of the underwriter’s evaluation will either be a conditional approval, suspension or denial.

- Conditional or contingent approval means you need to submit more documents to answer the underwriter’s questions, but as long as those documents check out, you should be cleared to close. Common requests include verifying the source of a large deposit to prove that it’s not a loan or verifying the source of a gifted down payment with a gift letter from the donor.

- Suspension means there’s a more significant question about your file. Your loan officer will work with you to resolve the underwriter’s questions.

- Denial means what it sounds like. Even if you were pre-approved, a thorough review of your finances by underwriting can mean that your loan is ultimately denied.

How Long the Underwriting Process Takes

According to the Homebuying Institute, an independent educational website for homebuyers, five to eight business days is a reasonable timeline for the mortgage underwriting process.

But the process also can take much longer than average. Every borrower’s circumstances are unique.

Several factors affect how long the mortgage underwriting process takes:

- The lender’s application volume and staffing levels

- The lender’s underwriting process

- The underwriter’s experience

- The type of loan you’re applying for

- How quickly you respond to the underwriter’s requests for documentation

- How complex your finances are

- The results of the home appraisal

The time it takes to close your loan includes the entire process from start to finish. The average time from application to closing was 45 days over the 12 months ending with August 2020, according to mortgage technology provider Ellie Mae. Underwriting is just one part of that process.

The next step after the underwriting process is complete is to review the closing conditions which I will cover next time. While I have covered the basics of the underwriting process, I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810. Be advised that any questions of a legal nature should be directed to your attorney.

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

06/21/21: Monopoly Mortgage Monday – Title Report

Hello again Southern Lakes Credit Union Members. Let’s play some more Mortgage Monopoly!You shake the dice, let them go, and watch as they tumble across the board. This time you land on the Title Report square. One of the most critical documents in the home buying and selling process is the title report.

Reasons for Reviewing a Property’s Title

Review of a property’s title, known as a title search, is a critical step in any home buying process. If you are buying a home, you want to be sure the person selling to you actually has the legal right to sell the property. As much as possible, you want to prevent any future questions of your ownership. You also want to avoid the burden of paying past owners’ debts. The title search will identify any issues in the chain of title, such as liens and judgments, problems with the legal property description, and other issues that could interfere with the transfer of ownership. About 25 percent of all residential real estate transactions have issues with the title that title professionals resolve before closing.

Additionally, most mortgage lenders and mortgage insurers require production of a title report. The results of the title search affect issuance of a title insurance policy, which protects the policy holder from financial losses due to defects in a property title. You likely will be required to pay for lender’s title insurance, which protects your mortgage holder’s investment in your property. You also can obtain owner’s title insurance to protect yourself and your interest in the property.

Possible Problems Found by a Title Report

The title report should uncover any defects in title that could interfere in the transfer of ownership. Common title problems include:

- Errors in public records: Mistakes made in official documents, such as clerical or filing errors, could affect the validity of the deed.

- Property liens: Banks or other financing companies could place a lien on the property for unpaid past debts of prior owners.

- Illegal deed: If a prior deed was made by someone not legally entitled to enter into a legal document, the enforceability of that deed could be affected. A deed could be illegal if made by a minor, someone not of sound mind, an undocumented immigrant, or someone reported as single who actually is married.

- Heirs: Sometimes heirs are unknown or missing at the time of a property owner’s death. Family members could contest the will to establish property rights.

- Forged documents: Forged documents affecting property ownership could be filed within public records that obscure the property’s rightful ownership.

- Encumbrances: A third party might hold a claim to all or part of the property, limiting the use of the property.

- Boundary disputes: Surveys might exist that show different boundaries of the property.

- Undiscovered will: The state sometimes sells a deceased property owner’s assets if that owner dies with no apparent will. However, if a will is discovered in the future, property rights can be jeopardized.

- Impersonation: If you buy a home once sold by someone falsely impersonating the property owner, then your legal claim to the property is at risk.

- Building code violations: Discovery of unresolved violations could affect a title.

Preparation of a Title Report

Though you could conduct a title search on your own, doing so is not recommended. A title report is best prepared by an experienced title officer, title company, or attorney who knows what information to review, where to locate documents, and how to interpret the content of those documents. A preliminary title report might be provided by the seller, but the buyer or buyer’s lender commission completion of the full title report, typically once the property is in escrow.

Documentation that relates to the property, its ownership, and the owner are reviewed to determine the chain of ownership and to locate possible issues with the title. Public records are the source of information. Specifically, information reviewed could include:

- Property deeds filed with the county

- County assessment records

- Mortgages

- County land records

- Divorce cases and settlements

- Bankruptcy court records

- Tax lien records

- Street and sewer assessments

- Land surveys

- Wills

- Court filings

- Tax search

Information Included in Title Reports

Title reports contain crucial information about the property, current ownership, and possible issues discovered related to ownership.

Schedule A

This section of the title report typically details the scope of the title search, title insurance policies to be issued, the full names of the current owners, and the type of land interest, such as fee simple.

Schedule B

Schedule B lists the encumbrances and exceptions that affect the property.

An encumbrance is any claim, lien, interest, or liability that attaches to the property, but does not necessarily prevent transfer of title. Some encumbrances that might bind all current and future ownership rights include: easements, restrictive covenants and restrictions, water or mineral rights, and property setbacks. Encumbrances that affect the current ownership and need to be released before the sale or they pass to the new owner include: mortgage interests, liens, and judgments.

Exceptions are those items tied to the property that will remain on record and transfer with the property. The buyer will receive a clear title except the buyer’s rights will be subject to conditions in those exceptions. Common exceptions include CC&Rs (covenants, conditions, and restrictions), recorded easements, leases, and homeowner’s association by-laws.

Schedule C

The legal description of the property generally is found in Schedule C. This description could take several forms, depending on how land records are documented in the local jurisdiction. The property description could be by lot and block, metes and bounds, partition plats, or subsections.

The next step after obtaining a Title Report is the submission of your mortgage file to Underwriting for review. I will cover that topic in depth for you next time. This is quite a bit of information to digest, so I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

06/14/21: Monopoly Mortgage Monday – Appraisal Report.

Welcome back, Southern Lakes Credit Union Members. It’s once again time to play Mortgage Monopoly!

You shake the dice real hard, toss them across the board, and land on the Appraisal Report square. Why do I need an appraisal, you ask? What information is provided in an appraisal report? A home appraisal protects both you and your mortgage lender and prevents you from paying too much for a house.

What You Get

Typically, a home appraisal report includes:

- Explanation of the valuation — Like math students, good appraisers show their work

- A brief overview of the local market’s trends — Are prices currently going up or down? If so, how quickly?

- Summary of the home’s characteristics — Its condition, size, and any improvements that have been carried out

- Other considerations — Has anything else about the home or its neighborhood affected the valuation?

- Structural problems and defects — Any issues that the appraiser noticed that affected his/her valuation

Basic Appraisal Report Review Functions

Once completed, the appraiser submits the completed report to the lender. The lender will then review all aspects of the appraisal.

The review’s purpose is to:

- Ensure the appraisal report contains the pertinent data available

- Determine whether the information logically relates to the conclusions made by the appraiser

- Determine whether the appraisal conforms with acceptable appraisal practices and techniques; and

- Decide whether the reasoning and logic applied to the data in the appraisal process result in a logical conclusion.

At this time the mortgage loan officer or processor will update you on any outstanding items which are still needed to ensure your loan application continues in the process. After the appraisal report is reviewed you will be provided with a copy of the report for your records.

The next step after you have reviewed your appraisal report is to obtain a Title Report. I will discuss that topic next time. This is quite a bit of information, and you may have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

05/03/21: Monopoly Mortgage Monday – Processing Square.

Hello Southern Lakes Credit Union Members. Once again, it’s time to play Mortgage Monopoly!

You shake the dice, give them a toss, and they tumble across the board. This time you land on the Processing square. Once your complete loan application has been submitted, the mortgage processing stage begins. For you, the buyer, this is mostly a waiting period.

But if you’re curious, here’s what happens behind the scenes:

First, the Loan Processor prepares your file for underwriting.

At this time, all necessary credit reports are ordered, as well as your title search and tax transcripts.

The information on the application, such as bank deposits and payment histories, are verified.

Respond ASAP to any requests during this period to ensure underwriting goes as smoothly and quickly as possible. (I will cover the underwriting process in another post.)

Any credit issues, such as late payments, collections, and/or judgments, will require a written explanation.

Once the processor has put together a complete loan package with all verifications and documentation, the file is then sent to the underwriter for review.

The next step after Processing is the review of the Appraisal Report. I will cover that topic in-depth for you next time. This is quite a bit of information to digest, so I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

04/19/21: Monopoly Mortgage Monday – Appraisal Order Square.

Hello, again Southern Lakes Credit Union Members. It’s time to play Mortgage Monopoly!

You give the dice a good shake, toss them across the board, and land on the Appraisal Order square. What is a home appraisal you ask? How does the process work? Whether you’re buying or selling a home, a critical step of the process is the home appraisal. As a buyer, a key part of getting a mortgage is having an appraisal performed to confirm the market value of the property.

Why Lenders Want an Appraisal

An appraisal is an unbiased, professional estimate of the value of a property for sale. Lenders generally require a home appraisal before they’ll issue a mortgage because they want to ensure the value of the property. If the actual market value of a property is lower than the sales price negotiation may need to happen between buyer and seller or additional cash down may need to be placed on the home prior to completing the mortgage.

How the Appraisal Process Works

The appraisal happens after an offer has been made and accepted. As the buyer, you’ll pay for the appraisal. When working with a realtor the appraisal company works with the realtor to complete the appraisal. If no realtor is involved the appraisal company will work with the seller and possibly you to arrange for the appraisal.

Once it’s complete, the report is sent directly to the lender. As part of the mortgage process, you may receive a copy of the appraisal also. Be sure to ask your lender for your copy.

The average cost of a professional appraisal typically ranges from $500 to $600. The price can depend on your property type and location. More expensive homes or homes that have more than one unit will typically cost more. Expect the appraisal process to take from 7 to 15 business days. With the current real estate market, it could take longer. The appraiser is a qualified professional who is licensed or certified to do the work and has no direct or indirect interest in the transaction.

Using Comps to Determine Market Value

The appraiser will research the area the home is in and will analyze the neighborhood as well as the details and condition of the house to provide an assessment of the fair market value.

The most important component involved in arriving at a property’s value is called comparable sales, or “comps.” These are similar properties, usually located within a mile or so of the home in question, which has sold in the last 90 days.

The appraiser compares several of the property’s features against the comps to arrive at the value. Factors include square footage, appearance, amenities, and condition.

For example, a large four-bedroom home in an area where mostly three-bedroom homes have recently sold will likely have a higher value than those comps. Likewise, a house with peeling paint and a patchy lawn in a well-manicured subdivision will typically appraise at a lower value than otherwise similar properties.

When the Property Appraises for Less than the Sales Price

Sometimes the appraised value of a house comes in lower than expected. This can affect several aspects of the sale.

If the lender is deciding your loan amount as a percentage of the property price, it will choose either the sales price or the appraised value, whichever is less. Most lenders won’t loan more than between 80% to 97% of the home’s fair market value, so the appraisal value of the home is important when it comes to how much you’ll be able to borrow.

If the property appraises at the same as or at more than the sales price, you’re on your way to get the loan amount you applied for. If it appraises for less, you will have to work with the seller and the lender to determine if negotiations need to occur, if you will have to put more cash down, or if the loan amount will need to be reduced.

Dealing With a Low Appraisal

A low appraisal can delay or even cancel a sale; buyers don’t want to overpay for a house, and sellers may not want to drastically lower the price they were hoping to get.

You have a few options if the appraisal comes in low. If you wrote your offer contract to include a contingency that requires that the property be valued at the selling price or higher, you can walk away from the deal.

Another option is to try to negotiate with the seller to reduce the sales price. A third alternative might be to put more money down to cover the difference between the appraised value and the sales price.

And you can always ask for the appraisal to be reviewed. Find out what comparable sales were used and ask if they’re appropriate.

The next step after you have an Appraisal Order is Processing. I will cover that topic for you next week. This is quite a bit of information, so I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

04/05/21: Monopoly Mortgage Monday – Homeowners Insurance Policy Time!

Good day. It’s time to play Mortgage Monopoly again Southern Lakes Credit Union members!

This time you give the dice a roll and land on the Homeowners Insurance Policy square. When purchasing homeowners insurance, you will need to provide your insurer with information about yourself and your home. You can apply for homeowners insurance online, over the phone, or in person at the insurer’s local office and you’ll usually get a quote the same day.

To better prepare yourself for the homeowners insurance shopping experience, be sure to do the following:

- Familiarize yourself with the basics of homeowners insurance

- Gather information about the house, like its replacement cost, style of build, and other characteristics like the roof age and type of heating system

- Compare coverage and rates from multiple companies, and select a policy

- Check your eligibility for any available policy credits and discounts

- Choose a billing plan and sign

Step 1: Understand your homeowners insurance needs

Before you begin shopping for your homeowners insurance policy, you should have a general idea of how much coverage you need to ensure your home and personal possessions are fully covered. You’ll also want enough liability coverage to withstand a potentially expensive lawsuit.

The following components are in every standard homeowners insurance policy. Having an idea of how much coverage you need for each policy provision will make you a more prepared shopper.

- Dwelling coverage – Your dwelling coverage limit should be equal to your home’s replacement cost, or how much it would cost you to rebuild the home in the event it was destroyed. Insurance companies will propose a home replacement cost for you during the quoting process, based on information like its square footage, number of bathrooms, and local rebuild costs. For a more accurate estimate, consider getting a proper replacement cost appraisal of your home

- Personal property coverage – Personal property coverage limit is typically set as a percentage of your dwelling coverage limit (typically 50% or 75%). To enhance your claim payouts and increase coverage limits on expensive valuables with strict coverage limitations, consider replacement cost contents coverage or scheduled personal property coverage

- Additional living expenses – If you live in an area that experiences frequent natural disasters, consider adding more loss of use coverage to your policy to cover relocation expenses if you’re displaced from your home. Loss of use coverage is typically 20% of your dwelling coverage limit, but it may be possible to increase your coverage limits

- Liability coverage – Liability coverage protects you from expensive lawsuits in the event you’re legally responsible for someone else’s injury or property damage. Insurers generally offer anywhere from $100,000–500,000 in protection. To determine how much coverage you need, add up the value of all of your assets, including your home, vehicles, investments, future wages, and personal belongings

- Medical payments coverage – Medical payments coverage is no-fault coverage for guests’ medical expenses if they’re injured on your property. Medical payments coverage is generally anywhere from $1,000 to $5,000

Step 2: Figure out how you want to shop for homeowners insurance

The best way to shop for any type of insurance — be it homeowners or life insurance — is to compare policies across multiple companies. Independent agents don’t work for an insurance company, so they can give you unbiased advice about which policy is best for you.

Step 3: Information you’ll need when you shop

The more details you have about the home, like the interior specs, the more accurate your quote will be.

Here’s a rundown of the information you may need to provide to your agent or broker in order for them to produce accurate quote estimates when you apply.

Home information

- Address of your home – The address of the property being insured

- Insurance appraisal – To determine the full rebuild value of the home if it’s damaged or destroyed. This can be done by referencing a recent home insurance policy, hiring an appraiser, or hiring roofing companies, contractors, and builders to assess value to individual parts of your home

- Lender requirements – Let your broker know if your mortgage lender requires any additional levels of coverage like flood insurance

You’ll also need to list who will be living in the insured home, whether you’ll be renting the home out or not and if you consider the home a primary or secondary residence. For example, if you’re renting it out or use the residence as a home office, your insurance broker may offer suggestions to maximize your home insurance tax deductions that are available for rental or home office properties.

Personal information

- Date of birth – This can help an agent or broker access your insurance history

- Occupation – Depending on your occupation, you may be eligible for certain discounts or group rates

- Social Security number – To access your credit history which better informs the rates you’ll be paying.

- Property history – If you haven’t lived at the home you’re seeking coverage for at least two years, you’ll be asked to provide addresses for previous residences

- Liability questions – Carriers will want to know if you have any pets, trampolines, tree forts, or pools (and whether the pool is above-ground or in-ground, specifically)

Step 4: Compare quotes and select a policy

After you’ve given your agent all the required information about your home, it’s time to get quotes and select a home insurance policy. Make sure to analyze a variety of policy options so you’re able to do a proper comparison, don’t automatically choose the cheapest policy without checking to make sure it’s got the coverage you need.

Apart from the policy itself, you’ll also want to look into the insurance company’s background. Be sure they’re a financially stable company, read reviews and check their ratings with third-parties like A.M. Best, J.D. Power, and Consumer Reports, to name a few.

Step 5: Finalize your policy details

You’ve compared quotes, gotten all your most pressing questions answered and selected a policy, now it’s time to choose a billing plan and policy deductible.

If you’re buying a home and need homeowners insurance to close on the property, there are a few details you need to finalize first:

Premiums – It’s common practice for lenders to require that premiums for the year be paid in full ahead of closing on your mortgage. Be sure to clarify with your agent if this is the case — the agent will be in contact with your lender about coverage and billing requirements for how your insurance will be paid moving forward.

- Deductible – You’ll also need to set your policy’s deductible, which is the amount you pay before your claim for damages is covered. From a cost standpoint, what you’re looking for is a low monthly or annual premium. So if you don’t plan on filing many claims, choose the higher deductible.

- Effective date – Lastly, you set the policy’s effective date, which is when your coverage begins.

Once your billing and policy dates are set and your lender approves the policy, you’re good to sign on the dotted line.

Step 6. Prepare for the insurance inspector

Your home insurance carrier will typically perform an inspection of the property to make sure everything is in order and reported as quoted. If anything is off or you forgot to mention something in your application, your adjuster will take note of the errors and omissions and you’ll see it reflected — for better or worse — in your next bill.

For example, maybe your roof is about 10 years older than you stated on your application; or on the flip side, maybe you forgot to mention that your home has certain protective features like a security system or stormproof windows that could lower your rates.

The next step after you have completed your search for a homeowners insurance policy is to get an Appraisal Order. I will discuss that topic next week. This is quite a bit of information, so I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Until next week folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

03/29/21: Monopoly Mortgage Monday – Roll the Dice! Application Square.

Welcome back once again Southern Lakes Credit Union members. It’s time to play Mortgage Monopoly!

This time you shake the dice, give them a toss and land on the Application square. After selecting a lender, the next step is to complete a full mortgage loan application.

Most of the application process was completed during the pre-approval stage. But a few additional documents will now be needed to get a loan file through underwriting.

For example, your lender will need the fully executed Purchase Agreement, as well as proof of your earnest money deposit.

Your lender may also request updated income and asset documentation, such as pay stubs and bank statements.

You will receive a Loan Estimate typically within three business days which will list the exact rates, fees, and terms of the home loan you’re being offered.

At this time you will also pay for an appraisal. Your lender will arrange for an appraiser to provide an independent estimate of the value of the home you’re buying.

Most lenders use a third-party company not directly associated with the lender.

The appraisal lets you know that you’re paying a fair price for the home.

Also, in order for the loan to be approved at the contracted purchase price, the home will need to appraise for the contracted purchase price.

The next step after you have signed your loan application is to begin your search to obtain Homeowners Insurance. I will cover that topic next week. This is a lot to digest, so I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810.

Please come back next week as we go to the next square on our board, “Homeowners Insurance.”

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

03/22/21: Monopoly Mortgage Monday – Roll the Dice! Contract Time.

Welcome back Southern Lakes Credit Union members to Mortgage Monopoly!

Time to roll the dice again! You give them a shake, toss them across the board and land on the Contract square. For homebuyers, real estate contracts can be bittersweet. The prospect of buying a house is exciting, but can also be quite daunting. There’s a lot at stake — your new home! — and a lot of boxes to tick before closing the deal.

Preparing for and wrapping your head around all the requirements leading up to the biggest purchase of your life is no small feat. It all hinges on what’s in a real estate contract. Knowing the composition of a real estate contract that’s competitive, realistic, and protects your best interests can literally make or break the deal. Having a knowledgeable and trusted Realtor assist you with this is imperative.

As you begin the search for a home to call your own, deftly navigating a real estate contract will help you conquer any obstacles along the way. Armed with the knowledge you need will lead you to a quick and painless closing in no time.

How a real estate contract works: The basics

When you’re buying a house, a real estate contract is the legal document that outlines the terms and details of a real estate transaction. The most common type is a purchase agreement. The primary purpose of a real estate contract is to clearly identify expectations of the buyer and seller and protect them both in the purchase process. Let’s break down how the contract works.

Step 1

An official offer form is prepared by the buyer’s real estate agent and submitted to the seller to accept or counter. Among other details, the offer will include a description of the parties and property, the purchase price offer, the earnest money deposit amount, the closing costs involved, and the proposed closing date.

Step 2

The seller accepts or rejects the offer. If the seller counters the offer, the seller or their listing agent will send back a counter-offer for the buyer to likewise accept or reject. A counter could include changes or modifications to one or more components of the offer, like purchase price, closing costs, or a contingency.

Step 3

It’s a deal! Or not. Once the seller accepts the initial offer or the buyer accepts the counter-offer, it becomes a legally binding contract, and both the buyer and the seller work to meet the terms and conditions outlined in the contract. If the buyer and the seller can’t agree on all the terms laid out in the offer, there is no agreement or contract.

So how quickly do negotiations and the offer become a signed, legally binding contract? Actually, pretty quickly, If there is only one buyer submitting an offer on a property, most of the time a transaction is agreed upon in the first 24 hours.

In a multiple-offer situation, many times a seller will put the property on the market for 24 to 72 hours knowing that they have an aggressively priced property. After the time allowed for multiple offers to come in, the seller will make a decision based on the best price and closing date. Once the offers are in for review, usually within 24 hours there’s a commitment and a signed contract.

The next step after you have signed a contract is the application process which I will cover next week. While I have covered the basics of a contract, I know you must have some questions. I invite you to reach out to me so I may help answer them. You can either leave them in the comment section below, message me here, or call me at (262) 723-4888 x810. Be advised that any questions of a legal nature should be directed to your attorney.

Please come back next week as we go to the next square on our board, “Application Process.”

Until next time folks! I am Joe Riesterer, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #290200

03/08/21: Monopoly Mortgage Monday – Roll the Dice! Make an Offer.

Hello Southern Lakes Credit Union members! Welcome back to our Mortgage Monopoly.

Congratulations! You have found the perfect home and are ready to roll the dice again! So, you pick up the dice toss them across the board and you land on the next space, Make an Offer This is one of the most exciting and nerve racking squares. This is where having a knowledgeable and trusted Realtor can really help you out. Your Realtor will talk with you about the home you want to make an offer on. Some things you will discuss are, the overall condition of the home, how much you love the home, and of course how much you are willing to pay for the home. In this current market because homes are being sold very quickly you will want to be prepared to make a quick decision here.

After you and your Realtor agree on the terms of your offer your Realtor will write up an Offer to Purchase and submit it to the seller along with your pre-approval letter. The pre-approval letter shows the seller that you have already been qualified for the loan and are serious about making a purchase. This is why a strong pre-approval letter from a reputable lender is very important. Once your offer is submitted, you and your Realtor wait to hear back and see if your offer is accepted. If your offer gets accepted, you get to move forward in the Mortgage Monopoly game and roll the dice again!!

The next step after your offer is accepted is reviewing the contract which I will go over next week. I know you have some questions, so I invite you to reach out to me to have those questions answered. You can either leave them in the comment section below, message us here, or call me at (262) 694-1600 x 604. Please come back next week as we go to the next square on our board, “Sales Contract.”

Until next time folks! I am Shelly Floreani, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #1436594

03/01/21: Monopoly Mortgage Monday – Roll the Dice! Find A Home!

Congratulations! You’ve completed the pre-approval process and are ready to roll the dice again! So, you pick up the dice toss them across the board and you land on the next space, Find A Home. This is one of the most exciting squares on our board, you get to go home shopping! However, before you do you want to do 2 things. You will want to; 1) Assess your wants and needs, and 2) Select a Realtor.

To assess your wants and needs put together a list with whomever you are buying your home with. If you are buying the home by yourself, you still want to make a list of needs and wants. Don’t skip this step. Knowing what you want out of your home will help you to be much happier with your homeownership experience and avoid regrets. So what kind of things should you consider? Probably number 1 on the list for most people is location. With location you’ll want to consider items like area schools, distance to work, character of the neighborhood, property values of similar homes and what nearby amenities are important to you. You’ll also want to make a list of needs and wants in the home itself. Some items to consider are, how many bedrooms and bathrooms you need now and possibly in the future? What size lot is important to you? What is the age and condition of the home?

After you have your list of needs and wants it is time to choose a Realtor! How do you choose a Realtor? Ask friends and family for their suggestions and who they were happy using. You can also ask me, your Mortgage Lender. I’ve been fortunate enough to work with several Realtors in the area and can suggest someone who I think would work well with you.

That is how you begin your home search! I know you have some questions, so I invite you to reach out to me to have those questions answered. You can either leave them in the comment section below, message me here, or call me at (262) 694-1600 x 604. Please come back next week as we go to the next square on our board, “Making an Offer.”

Until next time folks, I am Shelly Floreani, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS #1436594

02/22/21: Monopoly Mortgage Monday – Roll the Dice! Pre-Approval!

You’ve rolled the dice and landed on square 1, Pre-Approval! This is where the great game starts. There are 3 main areas we will look at to get you pre-approved. They are 1) Your income, 2) Your assets and 3) Your credit. Don’t worry if you feel like you are deficient in any of these areas. We can sit down and discuss some options for you. So what exactly do we look at in these 3 areas?

Your income – With income one of the main factors we are look at is stability. We like to see at least 2 years at a job. But, what if you recently graduated or changed jobs? Doesn’t that time count? Great question, and yes it does! If you have recently graduated from college and are now starting a new job in your field of study we can count your time in school as time towards the 2 years. If you have recently changed jobs, but are in the same career field than the time at your last job counts as well. If you change career fields without any education behind it, then unfortunately we are unable to count your previous job towards the 2 years. One more caveat to take note of is part time work. If you work part time then we would need 3 years of job history.

Assets – When we say assets, what do we mean? Do you need to provide everything? What we typically need for assets is two things. One, we need to know where the cash for closing is coming from. If it’s your checking/savings then we would need 2 months of the most recent bank statements. If it’s coming from a retirement account then we would need 2 months of the most recent statements for the retirement account. We also need to know where your income is being deposited. For most people this is their checking or savings account. Therefore, we would need 2 months of your most recent bank statements showing the income deposits.

Credit – Your credit is very important when it comes to getting a mortgage. In most cases we need a credit score of at least a 620. There are some instances where we can go below that, but it will be evaluated on a case by case basis. Your credit score will determine what loan program you qualify for. But you do not need to worry about that. We will go over it after you submit your application. And if your credit needs some polishing, I can let you know what is your best course of action to help improve your scores.

So you have all 3 pre-requisites checked off. What do you need to do in order to get your pre-approval? One, you will need to fill out an online application, which can be done on our website, or you can call me to schedule an in person appointment. Two, you will need to gather some documentation to prove your income and assets. Typically I will need the following documentation for this: 2 months of your most recent bank statements, 2 years of W-2s, and 30 days of your most recent paycheck stubs. We may also require 2 years of tax returns so it is good to have those ready too.

That folks, in a nutshell is what is required for your pre-approval! I know you have some questions, so I invite you to reach out to me to have those questions answered. You can either leave them in the comment section below, message us here, or call me at (262) 694-1600 ext. 604. Please come back next week as we go to the next square on our board, “Finding a Home.”

Until next time folks! I am Shelly Floreani, Mortgage Loan Officer with Southern Lakes Credit Union. NMLS# 1436594

02/08/21: Monopoly Mortgage Monday Begins

Hello Southern Lakes Credit Union members! I am excited to announce that we are going to begin a new series on the home buying process! What better way to do this than by using everyone’s favorite real estate game, Monopoly!

Beginning next week, I will show you what it takes to get you from Start to Finish and how to get more helpful “Community Chest” cards while avoiding the “Go to Jail” pitfalls.

When we get a Community Chest card they will explain what helpful things you can do to get your loan to closing faster. The “Go to Jail” cards will explain common areas that can derail your loan and prevent you from becoming a homeowner. I’m very excited to be sharing this with all of you. Please come back next Monday as we start on the first square, Pre-Approval!

If you have any questions as we go along feel free to post them below, message me here or call me directly at (262) 694-1600 ext. 604.